CrossBoundary Advisory

About Us

CrossBoundary Advisory combines local presence and networks with a global reach to bridge capital gaps.

We provide transaction and strategy advisory for investors, fund managers, companies, donors, and governments to mobilize capital into underserved markets.

For capital providers, we offer unmatched expertise across the investment lifecycle in underserved markets

For capital seekers, we offer a full-service approach to capital raising, expansion, and value creation to support their growth

For governments, company management, policymakers, and donors we provide strategic advice on how to address underserved markets globally

Capabilities

We provide our clients with the expertise they need to ensure the best outcomes

Our Approach to Blended Finance

As pioneers in blended finance, we know that intentional structuring is the key to driving both financial returns and long-term impact

Commercial Capital

We work with private investors who seek risk-adjusted returns while creating a positive impact

Catalytic Capital

Our impact-first clients seek structures that deliver on development goals while mobilizing private capital

When structuring blended finance vehicles, we help clients:

Efficiently apply catalytic capital to shape and develop underserved markets

Minimize concessionality, while still incentivizing pioneering transactions

Drive strong returns while creating long-lasting impact

Sectors

We provide a depth of knowledge and understanding of the most important sectors in underserved markets

Transactions

We have structured investment solutions in more than 75 markets globally

Engagements

-

CrossBoundary AdvisoryNigeria

CrossBoundary AdvisoryNigeriaNeed-Based Resource Allocation Using Geospatial Analysis

-

CrossBoundary AdvisoryConfidential

CrossBoundary AdvisoryConfidentialLeveraging Data to Understand Business Impact on Clients and Inform Strategy

-

CrossBoundary AdvisoryAfrica

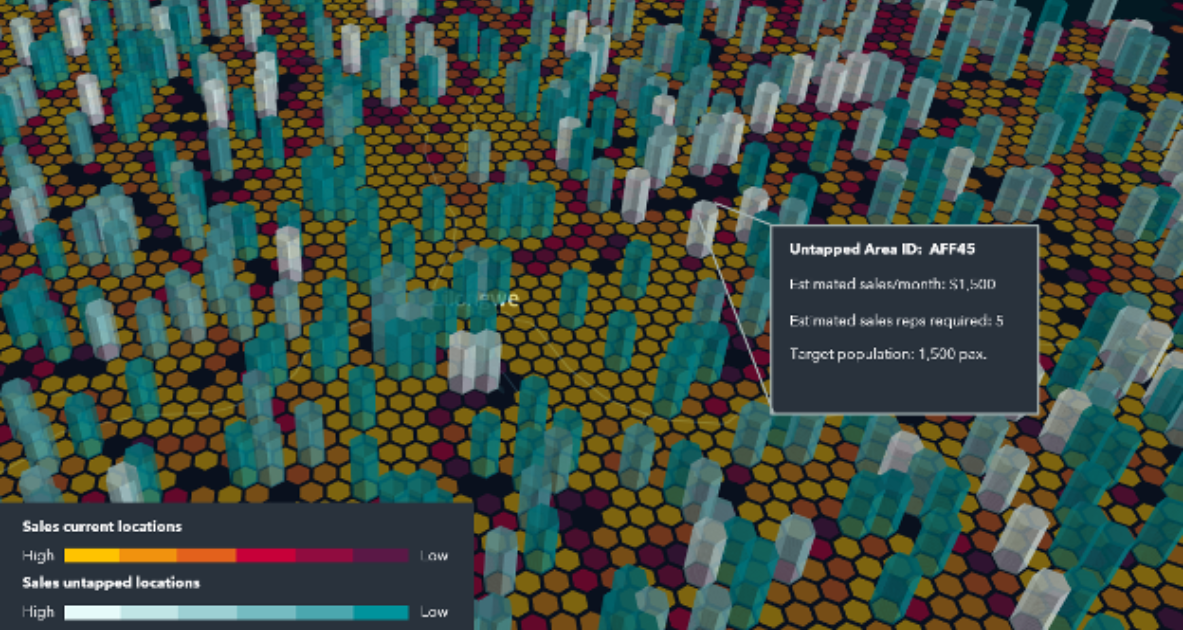

CrossBoundary AdvisoryAfricaHow Can E-Commerce Companies In Underserved Markets Use Data Science To Expand Their Business?

-

CrossBoundary AdvisoryAfrica

CrossBoundary AdvisoryAfricaData-Driven Expansion Strategy